For manufacturers requiring steel tubing for their products, the scarcity of metals has become a pressing issue with far-reaching implications. The volatility of the metal market, increasing demand, geopolitics, and growing governmental regulations are just some of the reasons contributing to the problem.

And to add insult to injury, large steel mills are stockpiling scrap metal to ensure they keep a steady supply of raw material during the shortage.

It’s causing a trickle-down effect for distributors and smaller manufacturers that used to find it easy to source off-the-shelf tubing. Some are seeing 4- to 6-month waits for their orders.

In this blog post, we’ll explore the ongoing metal shortage, why it’s happening, and discuss how some businesses are turning to centrifugal casting as an alternative resource for their metal tubing.

The volatility of the metal market

Greg Whitman, Vice President of Sales and Engineering for Spuncast, says looking back at the considerable upheaval and change over the last year is essential to understanding the shortages.

He points to factors like the war in Ukraine, climatic events, commodity trading, and a growing list of regulatory requirements as culprits.

At the same time, 2023 has brought an unforecasted increase for in-demand metals due mainly to significant movement in the manufacturing sectors.

It’s a combination causing lower availability and rising costs of this valuable commodity. Below are four of the main reasons behind the increase.

1. Demand going up

Despite supply issues, labor shortages, and an uncertain economic environment, Deloitte analysts see upward trends in emerging markets and technological advancements causing continued growth for manufacturing in 2023.

It’s growth that fuels the consumption and, therefore, the demand for metals.

As a result, Reuters reports that the World Steel Association expects steel demand to rise 2.3% this year to 1.822 billion tonnes. That’s up from a previously forecasted 1% rise.

2. Traders driving market

Though the impact of metal forecasters on the market is indirect, it can be significant depending on the credibility and influence of their predictions.

“Metal, in general, is a hot commodity at the moment,” Greg says. “Traders are buying and selling metal that they never actually take possession of, but that creates metals that are no longer available to purchase physically. It’s something that contributes to scarcity and price increases.”

According to S&P Global, a commodity insight company, we’re not likely to see changes in the market anytime soon. They show the latest tradable values continuing to increase, which contribute to the recent round of sheet metal price hikes and longer mill lead times.

3. Steel mills stockpiling scrap

For steel companies, scrap metal lowers costs and requires far less energy than new material. Recycling scrap metal from sources like junk cars, old appliances, and construction waste helps meet demand.

It’s also the same material that is supposed to offer an alternative to hard-to-obtain newly-mined metals for others in manufacturing too.

But, according to a recent ScrapWare article, the big U.S. steel mills are stockpiling a significant portion of scrap by acquiring sizable scrap businesses. Some notable acquisitions include:

- North America’s largest steel producer, Cleveland-Cliffs, and the recycler Ferrous Processing & Trading Co.

- The United States’ largest steel producer, Nucor, acquired Garden Street Iron & Metal Inc. in Florida and Grossman Iron & Steel Co. in St. Louis.

- North Star BlueScope Steel purchased MetalX LLC steel scrap processing operations in Indiana.

Fastmarkets, the commodity price reporting agency, says these investments alone have raised scrap demand by several hundred tons per month.

“Because a mill needs so much material to run, and they have such a great amount of buying power,” says Greg. “They can hoard a large supply and control the pricing.”

4. Geopolitics and regulations causing pain

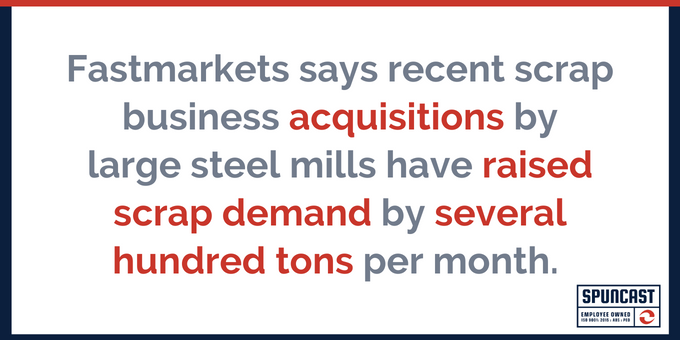

Ernst & Young (EY) cite the war in Ukraine as second only to ESG (environmental, social, and corporate governance) as the most significant factor impacting the trade of metals worldwide.

They also show how increasing competition between China and the US, and other newly elected governments in crucial mining markets, are negatively affecting the long-term outlook for the metal mining industry.

ESG regulations mentioned in the EY report also cause a direct impact on the availability of metals, leading to supply constraints and price volatility.

Miners indicated genuine concern when asked how the current geopolitical environment and the resulting regulations impact operations, as shown in the graph below.

Global climate uncertainty requires the industry to monitor and conform to changing regulatory developments in Europe, the UK, and the US. These are the countries driving standardization and laws that impact climate change risks.

Centrifugal casting offers options to small to midsize manufacturers

Even before any material shortages, making specific tube products from off-the-shelf tubes often means extra labor costs for fabrication or welding segments required to meet product dimensions.

That, coupled with the scramble for metal, means many manufacturers are reconsidering their options.

Because a centrifugal cast tube doesn’t usually need welding or fabrication and still uses a comparable material with similar, if not superior, results when made by a quality foundry, the process is an attractive alternative.

Compared to other methods, centrifugal casting gives companies unique advantages in efficiency, quality, and design flexibility when sourcing metal and designing tubes.

Centrifugal casting as a solution for metal shortage

Centrifugal casting presents several benefits that make it appealing during a metal shortage including:

- Material Optimization: By minimizing waste and reducing production costs, centrifugal casting optimizes metal usage. Only the necessary amount of molten metal is poured into the mold, minimizing material waste and maximizing efficiency.

- Enhanced Mechanical Properties: The centrifugal force exerted during casting results in improved mechanical properties. Centrifugal castings exhibit enhanced strength, reduced porosity, and improved defect resistance, ensuring high-quality and reliable products.

- Design Flexibility: Centrifugal casting offers design flexibility, allowing the creation of complex shapes and intricate geometries. This versatility is particularly valuable in industries that require customized components with specific performance requirements.

- Cost-effectiveness: Centrifugal casting reduces production costs by minimizing material waste, optimizing production time, and reducing the need for extensive machining.

But is it right for your business?

While centrifugal casting presents promising solutions, there are limitations and considerations to be aware of. Its applicability varies across industries and metal types, and implementation challenges may arise.

Greg says to determine if centrifugal casting is a good fit for your tube product, you should start with a conversation about design.

“We always ask, what are you normally buying? And then, what do you actually want?” he says. “If you’re currently buying a two-inch thick stainless steel tube because it’s what’s available but really only need a one-inch thick tube, now you don’t have to buy all that extra material just to cut it off. We can make it exactly to order.”

Because the centrifugal casting process focuses solely on making tubing in a nearly net zero capacity, it can work well for many companies. And for a boutique-size foundry like Spuncast, the supply chain delays that plague others in the industry are not an issue

“We’ve been able to meet the demand and fill that void in the market,” Greg explained. “And because we personally work with each customer, we can develop solutions that require less material and waste to create their part.”

Working with an experienced foundry

Because designing tubing components demands considerations of strength, load, performance, and other critical factors, working closely with a quality centrifugal casting foundry like Spuncast will ultimately save time and resources no matter the industry climate.

But, in particular, while the volatility and lack of availability of metal remain, centrifugal casting holds significant potential in mitigating the shortage.

Although it isn’t appropriate for every manufacturer, those needing custom tube products or an alternative to off-the-shelf tubing can look to it as a better way to navigate the ongoing impact. Chances are you’ll find it’s not only a better way to source your material but also a cost-efficient way to produce your tubes.